Thursday, April 30, 2009

The Pervasiveness of Tech

Even though this elegant NY Times image links to a really interesting article about cosmology and the seeming absurdity "...that you yourself reading this article are more likely to be some momentary fluctuation in a field of matter and energy out in space than a person with a real past born through billions of years of evolution in an orderly star-spangled cosmos. Your memories and the world you think you see around you are illusions." , the real reason for this post is to show just how pervasive tech has become.

Even though this elegant NY Times image links to a really interesting article about cosmology and the seeming absurdity "...that you yourself reading this article are more likely to be some momentary fluctuation in a field of matter and energy out in space than a person with a real past born through billions of years of evolution in an orderly star-spangled cosmos. Your memories and the world you think you see around you are illusions." , the real reason for this post is to show just how pervasive tech has become.Every day, untold millions of us bloggers create interactive content in ways undreamed of just five years ago, a fact that continues to amaze me while writing words destined to go up onto the Internet within seconds once this article is done. In every way, how we view and interact with reality (in conjunction with the five senses of course) depends, in part, on the ever advancing tech we continue to build as we move further into the 21st century.

I must confess, I was born at a very early age. — Groucho Marx

The Usual Suspects

Never in a thousand years would I expect to read articles like the ones posted today in Market Watch/Wall Street Journal & Portfolio.

Never in a thousand years would I expect to read articles like the ones posted today in Market Watch/Wall Street Journal & Portfolio.In Market Watch, Paul B Farrell explains why Goldman Sachs has such enormous power over America.

"Drama? You bet. Six short months ago Hank (Paulson - ex GS CEO) led an assault on Congress. The scene parallels one in "24:" Sangala War Lord Juma's brazen attack inside the White House. But no AK-47s necessary. The Hammer assaulted Congress with just a two-and-a-half page memo in hand. Like a crack special-ops warrior, he took down the enemy, demanding $750 billion, absolute control, total secrecy, no accountability and emergency powers to act immediately ... warning that inaction was not an option, that collapse of America's banking system was imminent, would bring down the global monetary system, pushing world's economies into a "Great Depression II." Congress surrendered.

Here's the whole plot:

Scene 1. American government is now run by the 'Goldman Conspiracy'

Oh, you really think just I'm plotting a television series? Or just paranoid, exaggerating this power grab? You better read "The Usual Suspects," Matthew Malone's brilliant article in Portfolio magazine. He "exposed" the "Goldman Sachs 'conspiracy' to take over the U.S. financial system." Read it in this context: America's financial sector has exploded from 19% of corporate profits in 1986 to 41% today, becoming a magnet for every wannabe billionaire. They know why Wall Street must control Washington.

Malone focuses on the incestuous "conspiracy" of Goldman alumni in Treasury, Bank of America, Merrill Lynch, AIG, Citigroup, Washington lobbyists and politicians."

As per Farrell's recommendation, check out this gem from Mark Malone's The Usual Suspects.

Now, with Goldman emerging from the financial crisis battered but still on top, the Street is seeing something more insidiously silly: a bona fide Goldman conspiracy. “A lot of people think that they must have gotten where they are because of some unfair advantage,” hedge fund manager Bill Fleckenstein says. “Nobody likes to think that someone flat out beat ’em.” (See a list of Goldman Sachs alumni and how they figure into the market turmoil of recent months.)

Believers point to the one degree of separation between Goldman bankers and recent financial events. Bush’s Treasury secretary, Hank Paulson, is a former Goldman C.E.O., and his replacement at Treasury, Tim Geithner, was mentored by Goldman alumni. Mario Draghi, who is leading the crisis response for the E.U., is a former Goldman vice chairman.

To put an exclamation point on all of this is Malone's Conspiracy Exposed time line delineating how GS wields power while the US economic system slowly collapses into the abyss.

Last but not least, read Michael Lewis' update on his Liar's Poker book to see why we are in such a mess.

Last but not least, read Michael Lewis' update on his Liar's Poker book to see why we are in such a mess.To this day, the willingness of a Wall Street investment bank to pay me hundreds of thousands of dollars to dispense investment advice to grownups remains a mystery to me. I was 24 years old, with no experience of, or particular interest in, guessing which stocks and bonds would rise and which would fall. The essential function of Wall Street is to allocate capital—to decide who should get it and who should not. Believe me when I tell you that I hadn’t the first clue.

I’d never taken an accounting course, never run a business, never even had savings of my own to manage. I stumbled into a job at Salomon Brothers in 1985 and stumbled out much richer three years later, and even though I wrote a book about the experience, the whole thing still strikes me as preposterous—which is one of the reasons the money was so easy to walk away from. I figured the situation was unsustainable. Sooner rather than later, someone was going to identify me, along with a lot of people more or less like me, as a fraud. Sooner rather than later, there would come a Great Reckoning when Wall Street would wake up and hundreds if not thousands of young people like me, who had no business making huge bets with other people’s money, would be expelled from finance.

When I sat down to write my account of the experience in 1989—Liar’s Poker, it was called—it was in the spirit of a young man who thought he was getting out while the getting was good. I was merely scribbling down a message on my way out and stuffing it into a bottle for those who would pass through these parts in the far distant future. "

There's a sucker born every minute - PT Barnum

Monday, April 27, 2009

Can You See Me Now?

It's just a matter of time before eyeglasses and contact lenses become heads-up displays that will literally change how we view reality.

It's just a matter of time before eyeglasses and contact lenses become heads-up displays that will literally change how we view reality.“Let the future tell the truth, and evaluate each one according to his work and accomplishments. The present is theirs; the future, for which I have really worked, is mine." - Nikola Tesla

The Finance Club

"Last June, with a financial hurricane gathering force, Treasury Secretary Henry M. Paulson Jr. convened the nation’s economic stewards for a brainstorming session. What emergency powers might the government want at its disposal to confront the crisis? he asked.

"Last June, with a financial hurricane gathering force, Treasury Secretary Henry M. Paulson Jr. convened the nation’s economic stewards for a brainstorming session. What emergency powers might the government want at its disposal to confront the crisis? he asked. Timothy F. Geithner, who as president of the New York Federal Reserve Bank oversaw many of the nation’s most powerful financial institutions, stunned the group with the audacity of his answer. He proposed asking Congress to give the president broad power to guarantee all the debt in the banking system, according to two participants, including Michele Davis, then an assistant Treasury secretary.

The proposal quickly died amid protests that it was politically untenable because it could put taxpayers on the hook for trillions of dollars.

“People thought, ‘Wow, that’s kind of out there,’ ” said John C. Dugan, the comptroller of the currency, who heard about the idea afterward. Mr. Geithner says, “I don’t remember a serious discussion on that proposal then.”

But in the 10 months since then, the government has in many ways embraced his blue-sky prescription. Step by step, through an array of new programs, the Federal Reserve and Treasury have assumed an unprecedented role in the banking system, using unprecedented amounts of taxpayer money, to try to save the nation’s financiers from their own mistakes."

Obama is beginning to resemble Woodrow Wilson regarding the economy; idealistic, eloquent and ineffective. Who knows, maybe Geithner is channeling Colonel House, Wilson's confidante extraordinaire.

Factoid: Congress cannot audit the Fed. Factoid II: We pay interest when we burrow our money from the Fed. Factoid III: The tax we pay to the IRS is said interest.

Addendum, check out the NY Times interactive calendar depicting Geithner's tenure as the NY Fed head. Fascinating to say the least.

Addendum, check out the NY Times interactive calendar depicting Geithner's tenure as the NY Fed head. Fascinating to say the least.Last but not least, Obama's Secret Plan by Charles Hughes really makes you think...

"If you set out to completely discredit the bankers and eviscerate their political power, you'd proceed exactly as Obama has done, enabling it to reach its reductio ad absurdum conclusion of fat bonuses and tax-funded bailouts in the trillions of dollars, at which point the public will rise up in fury, doing the work which was impossible for you, a new "liberal" president.

Imagine the uproar had Obama sought to send the bankers straight into deserved bankrupty and eliminated their looting; he would have been thwarted and second-guessed at every turn by politcos, pundits and the ultra-wealthy Aristocracy whose perks and privileges were threatened, not to mention a Republican Party spoiling to be spoilers.

What better way to discredit the bankers than to give them plenty of rope to complete their tarnished, fraudulent "plan to save Capitalism from itself"? How can they complain when their own bankrupt policies have been supported? "

In the back of my mind, I have thought about this scenario. I hope he's right and I am wrong about the Oman and the economy. Eating crow, in this instance, would be fine by me. :)

Tuesday, April 21, 2009

Why the System is Broken

"WASHINGTON — One of the leading House Democrats on intelligence matters was overheard on telephone calls intercepted by the National Security Agency agreeing to seek lenient treatment from the Bush administration for two pro-Israel lobbyists who were under investigation for espionage, current and former government officials say.

The lawmaker, Representative Jane Harman of California, became the ranking Democrat on the House Intelligence Committee after the 2002 election and had ambitions to be its chairwoman when the party gained control of the House in 2006. One official who has seen transcripts of several wiretapped calls said she appeared to agree to intercede in exchange for help in persuading party leaders to give her the powerful post...

The possibility that Ms. Harman might be under investigation surfaced in news reports in 2006. The CQ report provided new details, including quotations attributed to the transcripts of one of Ms. Harman’s conversations. Ms. Harman, CQ said, told the person who requested her aid that she would “waddle in” to the matter, “if you think it would make a difference.” Before ending the call, CQ reported, Ms. Harman said, “This conversation doesn’t exist.”

BTW, this happened prior to the 2004 election and the Times knew about it.

"Keller said she spoke to Mr. Taubman -- apparently at the request of Gen. Michael V. Hayden, then the N.S.A. director -- and urged that The Times not publish the article.”

To get another take on this story, click here.

Last but not least...

"We know that Jane Harman was blackmailed by the Bush Administration into supporting illegal spying on Americans.

But Dave Lindorff asks a really good question: was Harman the only Congress person blackmailed by the Bush Administration? Or were others blackmailed as well?"

Last but not least...

"We know that Jane Harman was blackmailed by the Bush Administration into supporting illegal spying on Americans.

But Dave Lindorff asks a really good question: was Harman the only Congress person blackmailed by the Bush Administration? Or were others blackmailed as well?"

Tech has no morality.

The same applies to politics. - RM

Textbook Publishing Redefined

One of the biggest PIA's in the world is getting college textbooks for Charley when Charley goes to college. Cost for one time use for books can easily top $1200, not to mention the environmental impact of having to throw these tomes of knowledge into the town dump when Charley is finished with them. (Many recycling centers have problems disposing of books but this is changing, thank god.)

One of the biggest PIA's in the world is getting college textbooks for Charley when Charley goes to college. Cost for one time use for books can easily top $1200, not to mention the environmental impact of having to throw these tomes of knowledge into the town dump when Charley is finished with them. (Many recycling centers have problems disposing of books but this is changing, thank god.)Enter FlatWorld Knowledge, a startup that has a viable solution to this most painful process of buying college textbooks.

"We preserve the best of the old - books by leading experts, rigorously reviewed and developed to the highest standards. Then we flip it all on its head.

Our books are free online. We offer convenient, low-cost choices for students – softcovers for under $30, audio books and chapters, self-print options, and more. Our books are open for instructors to modify and make their own (for their own course - not for anybody else's). Our books are the hub of a social learning network where students learn from the book and each other.

Wish this was available when my kid went to school.

Monday, April 20, 2009

For 10,000 Years

For 10,000 years, Taiwanese smoked pot, for the past 40, the US has waged a ridiculous, costly and ineffective war against it but the tide may finally be turning against this idiotic policy.

As a medley of border violence, recessionary pressure, international criticism and popular acceptance steadily undermines America's decades-long effort to eliminate drugs and drug use, the U.S. movement to legalize marijuana is gaining unprecedented momentum.

Once derided and dismissed by lawmakers, law enforcers and the law-abiding alike, marijuana reform is sweeping the nation, although the federal government appears committed -- at least for the time being -- to largely maintaining the status quo.

A week after Attorney General Eric Holder announced in March that raids on state law-abiding medical marijuana dispensaries would end, the Drug Enforcement Agency effectively shut down a San Francisco dispensary, claiming it violated both state and federal laws.

But to paraphrase Victor Hugo, not even the strongest government in the world can stop an idea whose time has apparently come.

Indeed, support for legalization is at an all-time high, and continues to grow. In 1969, just 12 percent of Americans favored legalizing marijuana, the Holy Grail of cannabis advocates; this number had tripled by 2005, according to a Gallup poll. Barely three years later, another poll showed 44 percent of Americans support legalization.

California is pushing to legalize and tax the herb as it makes good business to do so. (besides, CA is broke. )

Government should not be in the morality business, period. Why? Just examine the impact of the "wonderful" Volstead Act, a law that enabled Joe Kennedy to get rich and for the Mafia to become powerful.

Stop making Sense - Talking Heads

Addendum: Bill Moyer's interview with David Simon, creator of The Wire, says it all.

Listen, if you could be Draconian and reduce drug use by locking people up, you might have an argument. But we are the jailing-est country on the planet right now. Two million people in prison. When I started as a police reporter, 33, 34 percent of the federal inmate population was violent offenders. Now it's like, seven to eight percent. So, we're locking up less violent people. More of them. The drugs are purer. They've not-- they haven't closed down a single drug corner that I know of in Baltimore for any length of time. It's not working. And by the way this is not a Republican/Democrat thing. Because a lot of the most Draconian stuff came out of the Clinton Administration. This guy trying to maneuver to the center, in order not to be perceived as Leftist by a Republican Congress.

Listen, if you could be Draconian and reduce drug use by locking people up, you might have an argument. But we are the jailing-est country on the planet right now. Two million people in prison. When I started as a police reporter, 33, 34 percent of the federal inmate population was violent offenders. Now it's like, seven to eight percent. So, we're locking up less violent people. More of them. The drugs are purer. They've not-- they haven't closed down a single drug corner that I know of in Baltimore for any length of time. It's not working. And by the way this is not a Republican/Democrat thing. Because a lot of the most Draconian stuff came out of the Clinton Administration. This guy trying to maneuver to the center, in order not to be perceived as Leftist by a Republican Congress.

Learning How to Swim

Quite frankly, I don't really care what's causing global warming (I concur with Gore's take but some still think it's "nature's way" and not us.) but I do know chaos rules and linearity is not part of the equation when something like the climate undergoes a phase transition as it did 121,000 years ago in the last interglacial period, a period similar to what is going on right now.

Quite frankly, I don't really care what's causing global warming (I concur with Gore's take but some still think it's "nature's way" and not us.) but I do know chaos rules and linearity is not part of the equation when something like the climate undergoes a phase transition as it did 121,000 years ago in the last interglacial period, a period similar to what is going on right now."This happened over a long-term ecological timescale and was caused by a rapid jump in sea level of between 6.5ft and 9.8ft (two to three metres) that occurred around 121,000 years ago, say the researchers."

To see Nature Magazine's, source article, click here.

Click on the map below to get an interactive glimpse as to what 1.4 meters can do to San Francisco & environs.

If this doesn't wake people up, then maybe this will...

If this doesn't wake people up, then maybe this will..."University of Chicago scientists have documented that the ocean is growing more acidic faster than previously thought. In addition, they have found that the increasing acidity correlates with increasing levels of atmospheric carbon dioxide, according to a paper published online by the Proceedings of the National Academy of Sciences on Nov. 24."

or this.

(PhysOrg.com) -- Scientists at the University of Liverpool have found that heating from carbon dioxide will increase five-fold over the next millennia.

or this.

New research suggests that ocean temperature and associated sea level increases between 1961 and 2003 were 50 percent larger than estimated in the 2007 Intergovernmental Panel on Climate Change report.

Rubber duckys anyone?

Thursday, April 16, 2009

Cables, the Bane of Tech

A must read to get the low down on the myriad of cables used to connect up tech components. The NY Times did a big service by putting together a nifty slide show showing what these beasties do.

A must read to get the low down on the myriad of cables used to connect up tech components. The NY Times did a big service by putting together a nifty slide show showing what these beasties do.No, I will not try to find another slide show dealing with the "millions" of different ink cartridges in the marketplace as that giant PIA is just too painful to get involved with if you know what I mean. :)

Readibility

Readability : An Arc90 Lab Experiment from Arc90 on Vimeo.

As usual, my good friend Marty comes through big time with another gem. Readibility is a great idea who's time has come regarding computer displays, the web and browsers in terms of how to remove clutter when reading on the net.

Tuesday, April 14, 2009

Friday, April 10, 2009

Reach Out & Touch Someone Redux

"In its submission to a San Francisco district court, the Obama Justice Department states that any disclosures concerning the relationship between AT&T and the National Security Agency would “cause exceptional harm to national security.”

"In its submission to a San Francisco district court, the Obama Justice Department states that any disclosures concerning the relationship between AT&T and the National Security Agency would “cause exceptional harm to national security.”Sound familiar?

Here’s an AT&T engineer explaining just what NSA wants to keep from American citizens: that the NSA is engaged in the warrantless surveillance of all communications (whether telephone conversations, emails, IMs or in other forms) involving AT&T customers.

Melville's The Confidence Man was elected on 11/4/2008 because we had no choice. To see the reason why, check out George Carlin's video seen below. It's a stem winder to be sure.

To read Reach Out I, click here.

Thursday, April 09, 2009

College Tuition - Not

College too expensive? Try YouTube

The Google Inc.-owned YouTube has for the last few years been forging partnerships with universities and colleges. The site recently gathered these video channels under the banner YouTube EDU (http://www.youtube.com/edu ).

More than 100 schools have partnered with YouTube to make an official channel, including Stanford, MIT, Harvard, Yale and the first university to join YouTube: UC Berkeley.

To see how powerful a notion this is, play Lecture 7 of Leonard Susskind's Modern Physics concentrating on General Relativity. Recorded November 3, 2008 at Stanford University. This Stanford Continuing Studies course is the fourth of a six... Note: Susskind, is a Noble Laureate

Better yet, check out MIT's amazing Open Courseware initiative whereby all of MIT's 1800 courses are online and free for all to download and learn from. (BRT 01/19/2008)

When MIT did the deed in 2002, they open up a Pandora's Box to encourage countries and their colleges and universities to get into the act and they did, in spades. To see how this concept has taken hold, click on the Open Consortium logo seen below.

IMHO, this movement will become one of the prime drivers of higher education because Fred and Susy will no longer be able to send Harvey to Harvard when it costs a cool $70,000+ a year to do so. No doubt, well-off parents will continue to do the drill but it's clear colleges are going to take a hit because increasing tuition costs at a greater rate than that of inflation is a really bad idea in this tanking economy and, more importantly, given how fluid tech, science and the web are, the ability to solve complex problems is becoming more important than having a degree stating that one can so because having a degree does not confer competency in any given field, a fact well known to anyone who has had do the unpleasant task of firing a college graduate who could not get the job done.

IMHO, this movement will become one of the prime drivers of higher education because Fred and Susy will no longer be able to send Harvey to Harvard when it costs a cool $70,000+ a year to do so. No doubt, well-off parents will continue to do the drill but it's clear colleges are going to take a hit because increasing tuition costs at a greater rate than that of inflation is a really bad idea in this tanking economy and, more importantly, given how fluid tech, science and the web are, the ability to solve complex problems is becoming more important than having a degree stating that one can so because having a degree does not confer competency in any given field, a fact well known to anyone who has had do the unpleasant task of firing a college graduate who could not get the job done.

Wednesday, April 08, 2009

Paycheck

Paycheck, a pretty good movie adaptation from a short story by Phillip Dick, depicts how memory can be selectively edited, something long thought to be science fiction until now.

Paycheck, a pretty good movie adaptation from a short story by Phillip Dick, depicts how memory can be selectively edited, something long thought to be science fiction until now."The father’s advice led the son, eventually, to a substance called PKMzeta. In a series of studies, Dr. Sacktor’s lab found that this molecule was present and activated in cells precisely when they were put on speed-dial by a neighboring neuron.

In fact, the PKMzeta molecules appeared to herd themselves, like Army Rangers occupying a small peninsula, into precisely the fingerlike connections among brain cells that were strengthened. And they stayed there, indefinitely, like biological sentries...

Dr. Fenton had already devised a clever way to teach animals strong memories for where things are located. He teaches them to move around a small chamber to avoid a mild electric shock to their feet. Once the animals learn, they do not forget. Placed back in the chamber a day later, even a month later, they quickly remember how to avoid the shock and do so.

But when injected — directly into their brain — with a drug called ZIP that interferes with PKMzeta, they are back to square one, almost immediately."

To see how the memory molecule works, click on the NYT graphic below.

"Cypher: I know what you're thinking, 'cause right now I'm thinking the same thing. Actually, I've been thinking it ever since I got here: Why oh why didn't I take the BLUE pill?

"Cypher: I know what you're thinking, 'cause right now I'm thinking the same thing. Actually, I've been thinking it ever since I got here: Why oh why didn't I take the BLUE pill? Morpheus: The pill you took is part of a trace program. It's designed to disrupt your input/output carrier signal so we can pinpoint your location.

Neo: What does that mean?

Cypher: It means fasten your seat belt Dorothy, 'cause Kansas is going bye-bye."

Duality

In looking at the current state of our political and financial institutions, this Dilbert says it all as both are broken and nothing of substance is being done about it as we slowly move toward the abyss. While OBama waxes eloquently about the role of America in the world, we, the taxpayers, are being systematically screwed by the Fed, the bankster owned cartel protected by government that is ripping us off while our president tells us we need more credit to flow into the system in order to keep money in circulation. (Money as Debt) As stated in previous posts, if any other industry (or nature for that matter) operated in this fashion, said industry (or nature) would cease to exist because you need something to create something, a fact not consistent with how money is generated in this country under the auspices of the Federal Reserve.

This commentary is not a diatribe based on emotion (maybe a little, :) ) but rather commentary based on research contained in the BRT blog. (Type in The Fed in Search to see why.)

At the same time we see our politicians ignore us while humping for money to get reelected, the net never ceases to amaze me with the sheer amount of creativity and innovation shown by people all over the world. Everyday, something that was science fiction the day before becomes science fact today, available for all to see and be taken advantage of in developing new technologies that can change earth for the better. The net is the connect for the world, a resource that must remain free if we are to succeed as a species.

Facts which at first seem improbable will, even on scant explanation, drop the cloak which has hidden them and stand forth in naked and simple beauty.

Galileo Galilei

Monday, April 06, 2009

Reaching 400 - Liars' Loans

WILLIAM K. BLACK: Liars' loans.

WILLIAM K. BLACK: Liars' loans.BILL MOYERS: Why did they call them liars' loans?

WILLIAM K. BLACK: Because they were liars' loans.

BILL MOYERS: And they knew it?

WILLIAM K. BLACK: They knew it. They knew that they were frauds.

WILLIAM K. BLACK: Liars' loans mean that we don't check. You tell us what your income is. You tell us what your job is. You tell us what your assets are, and we agree to believe you. We won't check on any of those things. And by the way, you get a better deal if you inflate your income and your job history and your assets.

BILL MOYERS: You think they really said that to borrowers?

WILLIAM K. BLACK: We know that they said that to borrowers. In fact, they were also called, in the trade, ninja loans.

BILL MOYERS: Ninja?

WILLIAM K. BLACK: Yeah, because no income verification, no job verification, no asset verification.

Go to the Bill Moyers Journal, it gets even better, believe me.

Saturday, April 04, 2009

Dr. Johnson

A person who has always fascinated me is Samuel Johnson, the creator of the first English dictionary. Afflicted with Tourette Syndrome, Johnson was a polymath of the highest order who wrote poetry, taught and created a popular precursor to Dickens's serial writings titled The Rambler (that would run every Tuesday and Saturday for twopence each) in which he wrote essays dealing with religion and morality.

A person who has always fascinated me is Samuel Johnson, the creator of the first English dictionary. Afflicted with Tourette Syndrome, Johnson was a polymath of the highest order who wrote poetry, taught and created a popular precursor to Dickens's serial writings titled The Rambler (that would run every Tuesday and Saturday for twopence each) in which he wrote essays dealing with religion and morality. Johnson's dictionary, which was published in 1755, was considered to be the definitive source of the English language for over 100 years until the much larger and more comprehensive Oxford English Dictionary came out in 1888, something that never ceases to amaze me as Johnson was the sole creator of his work wile the OED was the creation of many.

Johnson's dictionary, which was published in 1755, was considered to be the definitive source of the English language for over 100 years until the much larger and more comprehensive Oxford English Dictionary came out in 1888, something that never ceases to amaze me as Johnson was the sole creator of his work wile the OED was the creation of many.Chaos Incarnate

Could chaos be the root of reality? If Dario Benedetti is right, the unification of Quantum and Relativity may be at hand using Chaos as the weapon of choice.

Could chaos be the root of reality? If Dario Benedetti is right, the unification of Quantum and Relativity may be at hand using Chaos as the weapon of choice.“It is an old idea in quantum gravity that at short scales spacetime might appear foamy, fuzzy, fractal or similar,” Benedetti told PhysOrg.com. “In my work, I suggest that quantum groups are a valid candidate for the description of such a quantum spacetime. Furthermore, computing the spectral dimension, I provide for the first time a link between quantum groups/noncommutative geometries and apparently unrelated approaches to quantum gravity, such as Causal Dynamical Triangulations and Exact Renormalization Group. And establishing links between different topics is often one of the best ways we have to understand such topics.”

In looking at fractals, the action always occurs at the edge, not the center as the edge separates two or more regions with differing properties. Because fractals are self similar and use feedback to drive the 2 1/2 space in stochastic fashion, (when fractals inhabit 2 space, in 3 space, the dimension goes to 3 1/2) the ability to see how chaos unifies quantum and relativity in reasonable fashion is difficult at best. Also, Mandlebrot's fractal (the top image) appears, to me, to be too stiff to handle the kind of transformations envisioned by Benedetti's concept of a fractal universe constantly changing dimension at different scales to encompass the totality of reality in which all things reside. Because nature abhors gradients, the fractals Benedetti may be thinking about, must, IMHO, be fluid enough to deal with nature's unsurpassed ability to eliminate gradients using her two laws of thermodynamics.

Another question to ask is what powers the fractals? Nature is an open system but there must be a "engine" to drive this amazing process. Ah, as Einstein said, "Question everything".

To address the visualization part of the equation, here is Apophysis, a truly innovative program that generates 3D fractals with the kind of transparency and grace akin to nature's as depicted by the image seen below courtesy of RM and Apophysis.

To address the visualization part of the equation, here is Apophysis, a truly innovative program that generates 3D fractals with the kind of transparency and grace akin to nature's as depicted by the image seen below courtesy of RM and Apophysis.Friday, April 03, 2009

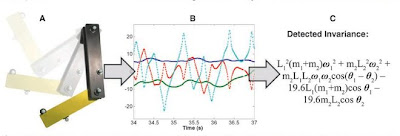

Hello Hal

"In just over a day, a powerful computer program accomplished a feat that took physicists centuries to complete: extrapolating the laws of motion from a pendulum's swings. Developed by Cornell researchers, the program deduced the natural laws without a shred of knowledge about physics or geometry."

"In just over a day, a powerful computer program accomplished a feat that took physicists centuries to complete: extrapolating the laws of motion from a pendulum's swings. Developed by Cornell researchers, the program deduced the natural laws without a shred of knowledge about physics or geometry."Using genetic algorithms in conjunction with recursion enables the app to learn on it's own, something that has escaped scientists for years in trying to harness compute power to intelligently analyze mountains of data systems generate on a daily basis. As stated in the article, the real power of the program will be to find new theories to explain information too complex for humans to understand, a powerful idea that resonates with profound implications with writers like Phillip Dick, Isaac Asimov and Arthur C. Clarke.

Click here to get a second take regarding this ground breaking research.

The only caveat to all of this is to make damn sure you don't tell the system to lie or conceal information as the end result can give one pause... :)

The only caveat to all of this is to make damn sure you don't tell the system to lie or conceal information as the end result can give one pause... :)Wednesday, April 01, 2009

Just a Follow Up

Just a follow up on volume and weight of money as per the 15 billion lost in Iraq last year courtesy of the BA. BRT: Economics 101 or Show Me the Money

Just a follow up on volume and weight of money as per the 15 billion lost in Iraq last year courtesy of the BA. BRT: Economics 101 or Show Me the MoneyIn the blurb, $15 billion of $100 bills filled up 4.295 railroad boxcars and weighed 165 tons. (Boxcar weight not included)

The $12.8 trillion committed by the Fed, FDIC and Treasury (Bloomberg) to "rescue" the US economy represents an amount 853 times larger than the aforementioned $15 billion (12,800,000,000,000/15,000,000,000 = 853) which means...

$12. 8 trillion dollars of $100s would fill up 3663.36 box cars

with a total weight of 140,745 tons.

Because dollars are now bits and not paper, weight drops to nothing, something akin to the fact money is created from nothing and is backed by nothing, an irony that makes one laugh and cry at the same time while our once great nation slowly goes into the poor house.

Tulip Time in the US.

Great post about Twitter from Incendia Media

Great post about Twitter from Incendia Media "Take today for example, I read that Facebook and Twitter agreed on a $500 million dollar valuation. Now lets be clear here, that's FIVE HUNDRED MILLION DOLLARS! And how much money does Twitter make? NONE! Quote from Wikipedia:"

"About USD 57 million of Twitter is owned by venture capitalists. Williams raised about USD 22 million in venture capital. Twitter is backed by Union Square Ventures, Digital Garage, Spark Capital, and Bezos Expeditions (led by Jeff Bezos of Amazon). Institutional Venture Partners and Benchmark Capital backed Twitter in 2009, investing an additional USD 35 million.The Industry Standard has pointed to its lack of revenue as limiting its long-term viability. As of January 2009, the service sold no advertising and produced no revenue. On February 13, 2009, Twitter announced on their official blog that they closed a third round of funding in which they secured more than USD 35 million."

and even better news from Bloomberg.

"The U.S. government and the Federal Reserve have spent, lent or committed $12.8 trillion, an amount that approaches the value of everything produced in the country last year, to stem the longest recession since the 1930s.

New pledges from the Fed, the Treasury Department and the Federal Deposit Insurance Corp. include $1 trillion for the Public-Private Investment Program, designed to help investors buy distressed loans and other assets from U.S. banks. The money works out to $42,105 for every man, woman and child in the U.S. and 14 times the $899.8 billion of currency in circulation. The nation’s gross domestic product was $14.2 trillion in 2008."

Houston, We have a problem.

Subscribe to:

Posts (Atom)